In the saturated market of financial applications, it's increasingly common to see companies stamping the "powered by AI" seal on their products. Artificial intelligence has become a mandatory selling point, but the question few ask is: does this AI actually work in an integrated way, or is it just an isolated feature added as an afterthought?

Fintrix emerges with a proposition that goes far beyond superficial AI marketing. While other platforms add basic chatbots or AI features in specific channels, Fintrix was built from the ground up as a truly integrated experience, where artificial intelligence permeates every channel, every functionality, and every interaction you have with your finances.

The Current Landscape: Facade AI vs Integrated AI

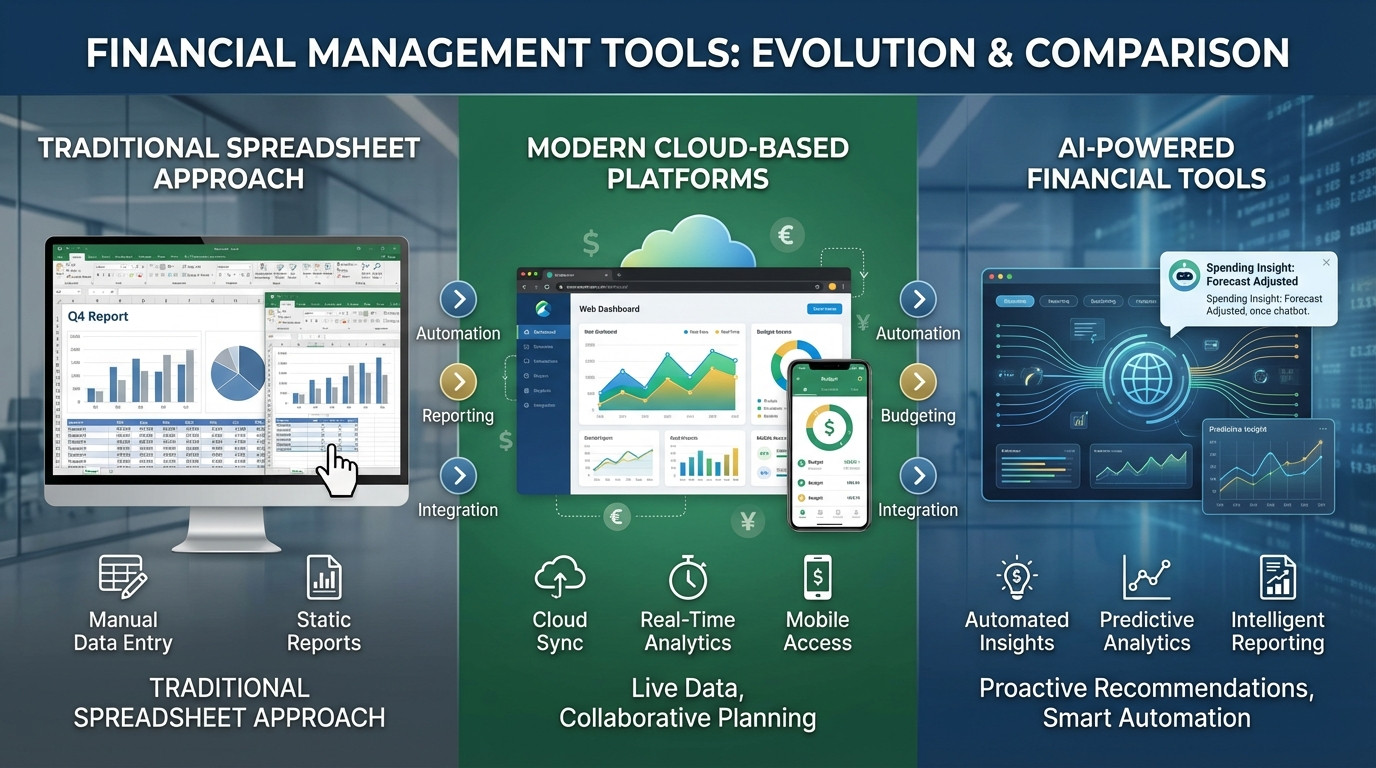

When we analyze the personal and business financial management market in 2026, we basically find three categories of platforms claiming to use artificial intelligence:

The first category includes platforms that added WhatsApp assistants as a complementary channel. You send messages through the messaging app, record your expenses via text or audio, and then access a basic web dashboard to view reports. The experience is fragmented: WhatsApp serves only for data entry, while analysis happens elsewhere, usually without the same conversational intelligence.

The second category comprises robust corporate financial management systems that implemented AI modules for specific tasks, such as predictive analysis, anomaly detection, or creating custom reports. These are powerful tools, but complex, expensive, and exclusively aimed at medium and large enterprises. AI here works as a specialized tool, not as a natural assistant that simplifies the user experience.

The third category brings together traditional mobile apps that added basic automatic categorization features and call it artificial intelligence. In practice, these are simple pattern recognition algorithms, far from genuine natural language processing capability.

And then there's Fintrix, which doesn't fit into any of these categories.

The Real Difference: AI Integrated Into a Complete Multi-Platform Experience

Fintrix is the only financial management platform that offers an AI assistant with natural language processing fully integrated into a genuine multi-platform experience: native mobile app, robust web platform, and WhatsApp—all synchronized with the same conversational intelligence working perfectly on whatever channel you choose to use.

This means you can start a financial analysis on your computer through the web platform, continue recording expenses via WhatsApp while you're out shopping, and finish by adjusting your financial goals in the mobile app before bed. The AI assistant is present in all these moments, understanding context, maintaining conversation continuity, and executing complex actions with the same ease on any platform.

Native Mobile App: Artificial Intelligence in Your Pocket

Fintrix's mobile app isn't just an adapted version of the website or a form to record expenses. It's a complete platform where you interact with your financial assistant through native voice commands and natural language conversations.

Imagine being at the supermarket and simply telling your phone: "I spent $237 on groceries, split between food and cleaning products." The assistant not only records the values but understands the division instruction, categorizes automatically, and updates your balance in real time. If you want to know whether you still have budget available for a special dinner this weekend, just ask: "How much can I still spend on restaurants this month?" and receive a contextualized answer based on your planning.

The fundamental difference here lies in native voice commands. We're not talking about sending audio messages through WhatsApp that are transcribed and processed externally. The Fintrix app has integrated voice recognition, real-time natural language processing, and the ability to execute complex actions instantly, all offline when necessary.

Web Platform: Complete Management with Conversational Intelligence

Fintrix's web version offers all the robustness you'd expect from a professional financial management platform: interactive dashboards, detailed charts, customizable reports, management of multiple accounts and cards, complete financial calendar, and control of goals and objectives. But what really sets it apart is how you interact with all of this.

Instead of needing to navigate through dozens of menus, click multiple buttons, and fill out endless forms, you simply chat with the assistant integrated into the platform. Want to create a comparative report of the last six months showing the evolution of transportation expenses? Type or say: "Create a report comparing my transportation expenses for the last six months, showing the trend and main variation factors."

The assistant not only generates the report but adds automatic insights identifying, for example, that your transportation costs increased 23% since you moved neighborhoods, or that rideshare app usage tripled during rainy months. This layer of contextual intelligence transforms raw data into truly useful information.

A feature that perfectly exemplifies this integration is intelligent bank statement import. You simply upload a PDF of your statement, and the AI assistant automatically reads, analyzes, and categorizes all transactions, presenting them for your organized review by category, identifying patterns, and even suggesting budget adjustments based on imported data. All of this happens through a natural conversation where you can ask for clarifications, make adjustments, and approve categorizations with simple commands.

WhatsApp: Your Financial Assistant Always Available

Fintrix's WhatsApp integration goes far beyond a simple bot that receives pre-programmed commands. It's a complete extension of the AI assistant that works on other platforms, with full access to your financial data and the ability to execute virtually any action you would do in the app or web.

You can send simple messages like "I spent 45 dollars on lunch" and the assistant automatically records it in the correct category. But you can also make complex queries like "show me a summary of my expenses this week compared to last week, highlighting where I spent more" and receive a complete analysis clearly formatted directly in WhatsApp.

The real magic happens in instant synchronization. If you're working on a report in the web version and need to rush out, you can continue exactly where you left off through WhatsApp. The assistant maintains conversation context, remembers what you were analyzing, and can even send the finalized report to your email when you request it.

Additionally, the WhatsApp assistant is proactive. It sends automatic reminders about upcoming bills, alerts when you're close to exceeding your budget in any category, and shares weekly insights about your spending patterns. All of this in natural conversations, as if it were a personal financial consultant always available in your favorite messaging app.

Total Synchronization: A Truly Unified Experience

What makes Fintrix unique isn't just having three different channels, but how they work as an integrated ecosystem. Every transaction, every conversation with the assistant, every budget or goal adjustment is instantly synchronized across all platforms.

You can start by defining a savings goal through WhatsApp during breakfast, adjust parameters in the mobile app during lunch break, and track detailed progress on the web dashboard when you get home. The AI assistant is present at every stage, understanding the complete context and offering personalized suggestions based on your financial behavior in real time.

This synchronization also extends to shared access. Fintrix allows adding up to three emails for shared access to the same account, ideal for couples, families, or small businesses. Each person can use their preferred channel, the AI assistant recognizes who's interacting, and keeps all data perfectly organized and accessible to all authorized users.

Intelligence That Goes Beyond Basic Categorization

Many platforms limit themselves to automatically categorizing transactions and call that artificial intelligence. Fintrix goes exponentially further. The assistant learns from your behavior patterns, identifies trends before they become problems, and offers genuinely useful proactive recommendations.

For example, if the system identifies that you always spend more on restaurants on weekends preceding a large bill payment, it proactively suggests adjusting your budget or reallocates amounts to prevent you from going into the red. If it notices your healthcare expenses increased in recent months, it questions whether you'd like to create a specific category to better track or adjust your planning.

Fintrix's AI also understands temporal and seasonal context. It recognizes that gift expenses naturally increase in December, that education costs peak at the start of the school year, and that travel expenses concentrate during vacations. This information is used to offer more accurate forecasts and more relevant alerts.

Advanced Features with Simple Interface

Fintrix offers sophisticated functionalities you'd normally find only in expensive enterprise systems: management of multiple accounts in different currencies with automatic conversion, detailed credit card control including installments and invoices, financial calendar with visualization of future commitments, robust goals and objectives system with progress tracking, predictive cash flow analyses, and much more.

But the genius lies in how all of this is accessible through natural conversations. You don't need to take a course to learn how to use the platform. You don't need to watch long tutorials or read extensive manuals. Simply chat with the AI assistant as you would with a human financial consultant, and it guides you through any functionality, no matter how complex.

Want to set up a detailed budget with multiple categories and subcategories? Say: "I need to create a monthly budget, help me organize it." The assistant asks relevant questions, suggests categories based on your history, adjusts values according to your answers, and sets everything up in minutes.

Need to understand why you spent more this month than the previous one? Ask: "Why did my expenses increase this month?" and receive a detailed analysis with the main factors, variations by category, and specific suggestions on where you can save.

Multi-Currency: Financial Management Without Borders

While most Brazilian platforms focus exclusively on reais, Fintrix was built from the beginning as a global solution. You can manage accounts in euros, dollars, reais, pounds sterling, Swiss francs, and various other currencies, all on the same platform.

Conversion is automatic and in real time for your consolidated dashboard, but you maintain full transparency about original values in each currency. This is especially valuable for freelancers working with international clients, entrepreneurs importing products, digital nomads, or simply people who travel frequently and want to maintain precise control of expenses in different countries.

The AI assistant naturally understands commands in multiple currencies. You can say "I spent 50 euros in Paris on dinner" and "I received 2000 reais from freelance work" in the same conversation, and everything is correctly recorded, converted when necessary, and presented clearly in your consolidated dashboard.

Security and Privacy as Priority

With all this integration and synchronization of sensitive financial data across multiple platforms, security is absolutely critical. Fintrix implements the most rigorous data protection measures available in the market.

All information is encrypted with Argon2ID, considered one of the most secure encryption algorithms currently available. Communication between all channels uses HTTPS with latest-generation SSL/TLS certificates. The system includes enhanced two-factor authentication (2FA), CSRF (Cross-Site Request Forgery) protection, and multiple layers of security validation.

Fintrix is fully compliant with GDPR (European data protection regulation) and LGPD (Brazil's General Data Protection Law), ensuring your personal and financial information is treated with the highest standard of privacy and protection. You have full control over your data, with transparent options for export, password change directly in your profile, and granular management of access permissions.

The End of the Learning Curve in Financial Management

One of the biggest historical barriers for people to maintain consistent financial control has always been the complexity of available tools. Spreadsheets require formula knowledge and disciplined organization. Traditional apps have confusing interfaces with dozens of buttons and functionalities hidden in deep menus. Professional systems demand extensive training and dedication to master.

Fintrix completely eliminates this barrier. From the first moment, you interact with your finances in the most natural way possible: by talking. You don't need to figure out where the button is to add an expense, which field to fill first, or how to configure reports. You simply say what you want to do, and the AI assistant takes care of everything.

This conversational approach doesn't mean limited functionality. On the contrary, you have access to extremely advanced features, but through an interface that anyone can use immediately. A teenager receiving their first allowance has the same ease of use as a CFO managing multiple business accounts.

Real Accessibility: Use How and When You Prefer

True accessibility isn't just about having a mobile app or web version. It's about recognizing that people have different preferences, different routines, and different needs at different times.

Some people prefer the large computer screen for detailed analysis but want the convenience of their phone for quick records. Others live in WhatsApp and want to manage everything there without opening another app. There are those who like voice commands while driving, and those who prefer to type calmly when at home.

Fintrix not only allows all these forms of interaction but ensures the experience is excellent in all of them. It's not a main channel with basic secondary integrations. These are three complete platforms, each optimized for its specific purpose, unified by the same conversational artificial intelligence.

Transforming Data into Real Decisions

The ultimate goal of any financial management tool isn't just to organize numbers, but to empower you to make better decisions about your money. This is where Fintrix's integrated artificial intelligence truly shines.

The assistant doesn't just answer questions, it asks the right questions. Identifies patterns you wouldn't notice manually. Alerts about concerning trends before they become serious problems. Suggests savings opportunities based on deep analysis of your financial behavior.

Want to know if you can take that trip you're planning? Don't need to open spreadsheets, calculate manually, or guess. Ask: "Can I travel spending up to $5,000 in March without compromising my other goals?" The assistant analyzes your projected cash flow, considers your income and fixed expenses, evaluates your savings goals progress, and provides a clear and grounded answer.

Need to decide if it's the right time to change cars? Ask: "If I add a $1,200 monthly payment, how does this impact my budget?" and receive a detailed simulation showing exactly which categories would be affected and whether you could maintain your current goals.

The Future of Personal Financial Management Has Arrived

While the market still debates how to add artificial intelligence features to legacy systems, Fintrix already delivers today the complete experience that defines the future of personal and business financial management.

An experience where you don't need to be an accountant to understand your finances. Where you don't need to be a technology expert to use powerful tools. Where naturally talking about money results in automatic actions, intelligent insights, and real control over your financial life.

The difference isn't just in the technology used, but in the design philosophy. Fintrix wasn't created as just another financial app with AI added later. It was conceived from the beginning as an intelligent assistant that lives where you live: on your phone, on your computer, in your WhatsApp, always synchronized, always contextualized, always useful.

Experience the Real Difference

It's easy to say a platform uses artificial intelligence. It's simple to add a basic chatbot and call it innovation. But building a genuinely integrated experience, where AI works perfectly across multiple platforms, understands complex context, executes sophisticated actions, and actually simplifies financial management? That's extremely rare.

Fintrix offers a 15-day unconditional guarantee. Use all channels. Chat with the assistant. Test synchronization. Import your statements. Set up complex goals. Ask difficult questions. Try shared management. And see for yourself the difference between AI marketing and truly integrated artificial intelligence.

You can continue using fragmented tools, where WhatsApp is just a disconnected data entry channel, where analysis requires navigating complex interfaces, where each platform is a different experience. Or you can try Fintrix and discover how financial management should be: conversational, integrated, and genuinely intelligent.

Financial management doesn't need to be complicated. With Fintrix, it finally isn't.